On March 11, 2020, the Centers for Medicare and Medicaid Services (CMS) announced the Part D Senior Savings Model. The intent of this voluntary payment model is to lower Medicare beneficiaries’ out-of-pocket costs for insulin to a maximum $35 copay per 30-day supply throughout the benefit year. The agency estimates $250 million in savings to the program over five years and an average 66% decrease in out-of-pocket costs for beneficiaries that join Part D plans participating in the model.

The rollout of a payment model focused on reducing the cost of insulin for Medicare beneficiaries is not unexpected, it is part of a larger ongoing effort by the Administration to address the rising costs of pharmaceuticals. In 2018, the Administration laid out plans for reducing drug prices for Americans when it released, Blueprint to Lower Drug Prices. This was followed by a series of other efforts and initiatives to reduce the price of drugs, many of which have not been finalized, or are held up by litigation. The rising price of insulin specifically has also been a hot-button issue raised by many of the candidates during the Democratic presidential primary as well as Congress. Committees in both the US House of Representatives and the US Senate have held hearings on drug costs focusing on rising insulin prices and the challenges patients face in affording this medication. In January 2020, the Trump Administration indicated that it was working on a plan to reduce insulin prices which resulted in the announcement of this model.

People with both Types 1 and 2 diabetes use insulin to control blood glucose levels. Insulin is a critical issue for Medicare both because of the number of beneficiaries who use it, and the growth in Medicare spending on insulin. More than 3.3 million Medicare beneficiaries are prescribed insulin, and a recent Kaiser Foundation report indicates that Medicare spending on insulin has increased significantly in recent years. According to this analysis, Part D spending on insulin increased by 840% between 2007 and 2017, from $1.4 billion to $13.3 billion per year, resulting in overall spending of $69 billion during that time period. Medicare beneficiaries also bear the burden of increased costs—the same Kaiser Foundation report found that Medicare Part D enrollees’ out-of-pocket spending on insulin quadrupled between 2007 and 2016, from $236 million to $968 million.[1]

The growing financial burden of insulin on the Medicare program and its beneficiaries, combined with political pressure to address the rising cost of insulin, created the impetus for the Part D Senior Savings Model.

The intent of this new model is to provide Medicare Part D beneficiaries access to insulin at a consistent and predictable monthly price of no more than $35.

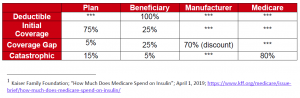

The current Part D defined standard benefit design includes four coverage phases:

The plan, beneficiary, manufacturer and Medicare have varying levels of responsibility during these different phases of coverage.

Medicare Part D Standard Benefit Design

Currently, beneficiaries with Part D coverage may face high out-of-pocket costs for drugs in the coverage gap phase. Under this model, beginning January 1, 2021, beneficiaries will be offered prescription drug plans that provide supplemental benefits for insulin in the coverage gap phase of the Part D benefit, so that beneficiaries would pay no more than $35 per month for insulin throughout the benefit year. The model would only apply to “enhanced” Part D plans and Medicare Advantage plans that offer prescription drug coverage and enrollees who do not qualify for the Part D low-income subsidy. The model is limited to applicable drugs that are or contain a drug classified as insulin. Assuming a certain number of beneficiaries will migrate from basic Part D plans to supplemental Part D plans, CMS anticipates 1.3 million beneficiaries will be eligible for the model.

Current Coverage Gap Policy and Modified Policy Under Model

While Part D sponsors can offer enhanced coverage in the coverage gap phase for some covered Part D drugs, there currently is a financial disincentive to do so for applicable drugs that receive a manufacturer coverage gap discount. Under current policy, if the plan offers no supplemental benefits the manufacturer’s 70% discount is applied to the total negotiated price of the drug, the beneficiary pays 25% and the plan pays 5%. In contrast, if under the current policy the plan offers a supplemental benefit and reduces the enrollee’s co-pay, the 70% manufacturer discount does not apply to the negotiated price, but just to what the plan has designated as the reduced copay for the enrollee. This results in an increased liability for the plan during the coverage gap since the 70% discount is only being applied to a small portion of the negotiated price and as a result the plan’s liability is increased. This creates a financial disincentive to reduce enrollee copays during the coverage gap phase.

Under the model, this restriction would be waived and the manufacturer would agree that any plan supplemental benefits apply after the 70% manufacturer discount is applied to the full negotiated price. CMS believes this would allow manufacturers and insurers to negotiate more freely.

The model will require the participation of both manufacturers of insulin and Part D plans with insulin on their formulary. Currently, there are three insulin manufacturers in the United States: Eli Lilly, Novo Nordisk and Sanofi. All three manufacturers have indicated that they will participate.

Voluntary Manufacturer Participation Requirements

Voluntary Plan Participation Requirements

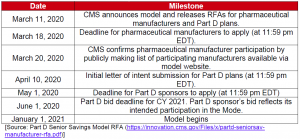

A summary of the model’s timeline is provided below:

Medicare Part D has symmetric risk corridors, which enable risk to be shared between plans and the Medicare program. A risk corridor limits each plan’s overall losses or profit if actual spending is much higher or lower than what was anticipated.

To encourage broad participation in the new model, CMS will give Part D plans the option of additional risk corridor protection (2.5% instead of 5%) for Calendar Year 2021 and CY 2022 for plan benefit packages that have a statistically significant (i.e., one standard deviation) higher enrollment than average from insulin-dependent diabetic patients, when the plan benefit packages meets qualifying criteria.

CMS will evaluate the impact of the model by monitoring several factors:

CMS says that although it will try to collect data via public data sources, model participants will be required to cooperate with primary data collection activities, which may include participation in surveys, interviews, site visits and other activities.

The participating Part D plans also will be allowed to offer rewards and incentives program with a focus on promoting improved health outcomes, medication adherence and the efficient use of healthcare resources. These may be designed to target enrollees with pre-diabetes and diabetes.

CMS argues that the Part D Senior Savings Model offers a more consistent co-payment for insulin for Medicare Part D beneficiaries by modifying federal regulations and removing the financial disincentive for plans to reduce beneficiary cost sharing during the coverage gap phase. If the model is successful, it has the potential to provide relief to a large number of Medicare beneficiaries. A successful model would also be a significant political win for the Administration in the run-up to the election in an area it has identified as a priority—reducing pharmaceutical prices.

Fact Sheet

Press Release

Part D Senior Savings Model Website

Manufacturer RFA

Plan RFA

For more information, contact Sheila Madhani.